CLIENT

Länsförsäkringar Bank

Länsförsäkringar Bank

My Role

UX Design

UI Design

UX Research

Usability tests

Prototyping and demoing

Stakeholder communication

UX Design

UI Design

UX Research

Usability tests

Prototyping and demoing

Stakeholder communication

Description of the assignment

As a lead-UX designer for the public pages, I led the work of improving the mortgage flow

As a lead-UX designer for the public pages, I led the work of improving the mortgage flow

PROBLEM STATEMENT

Länsförsäkringar needed to increase the number of digitally acquired customers in general and mortgage customers in particular. In order to do this, the client needed a modern website that met the needs of the target group and that strengthened the Länsförsäkringar brand.

I worked as part of an agile team that together iterates new versions of the site with the help of user data, A/B tests, user interviews and more. Me, together with a data scientist have developed strategies to maximize the number of mortgage applications. The result has been a well-functioning web with a steadily increasing number of visitors, a higher conversion rate and more satisfied customers.

Project Goals

1. Increasing the click-through rate

2. Enabling users to understand and engage more in interest rates

3. Creating better UX-copy that users understand

4. Better integration with services such as Hemnet

5. Improving UI, especially towards mobile

6. Improve accessibility according to WCAG 2.0

INITIAL USER TESTS

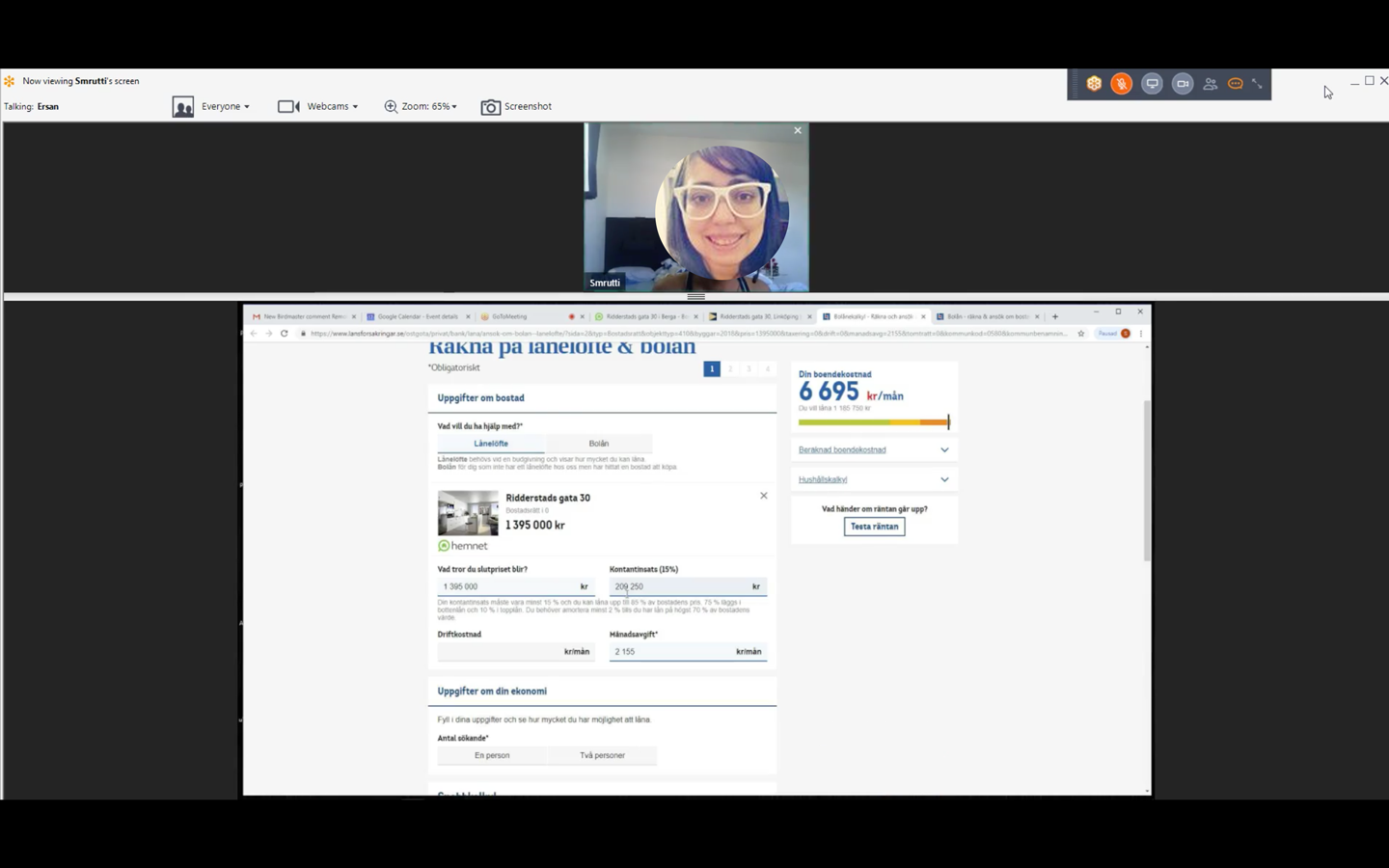

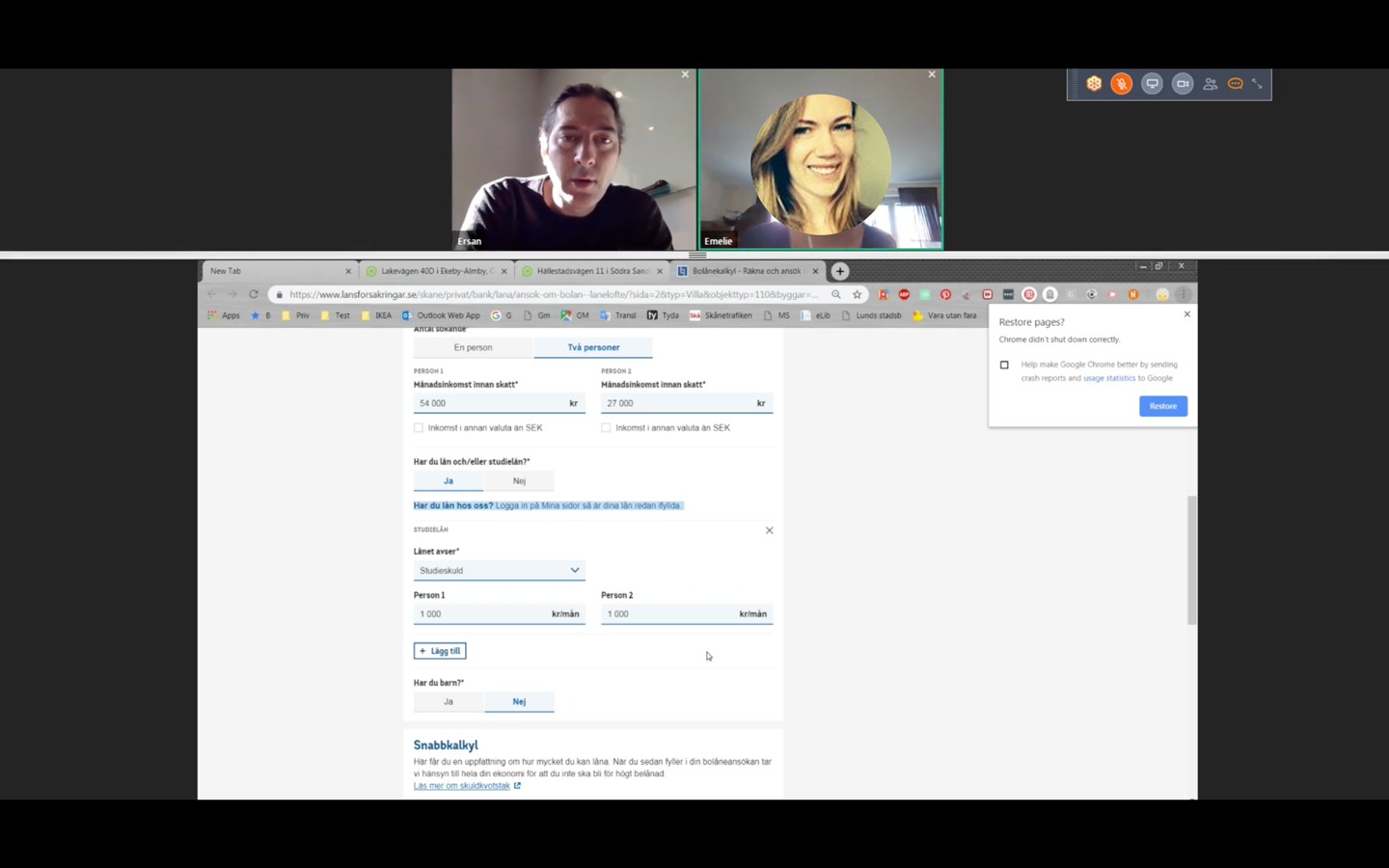

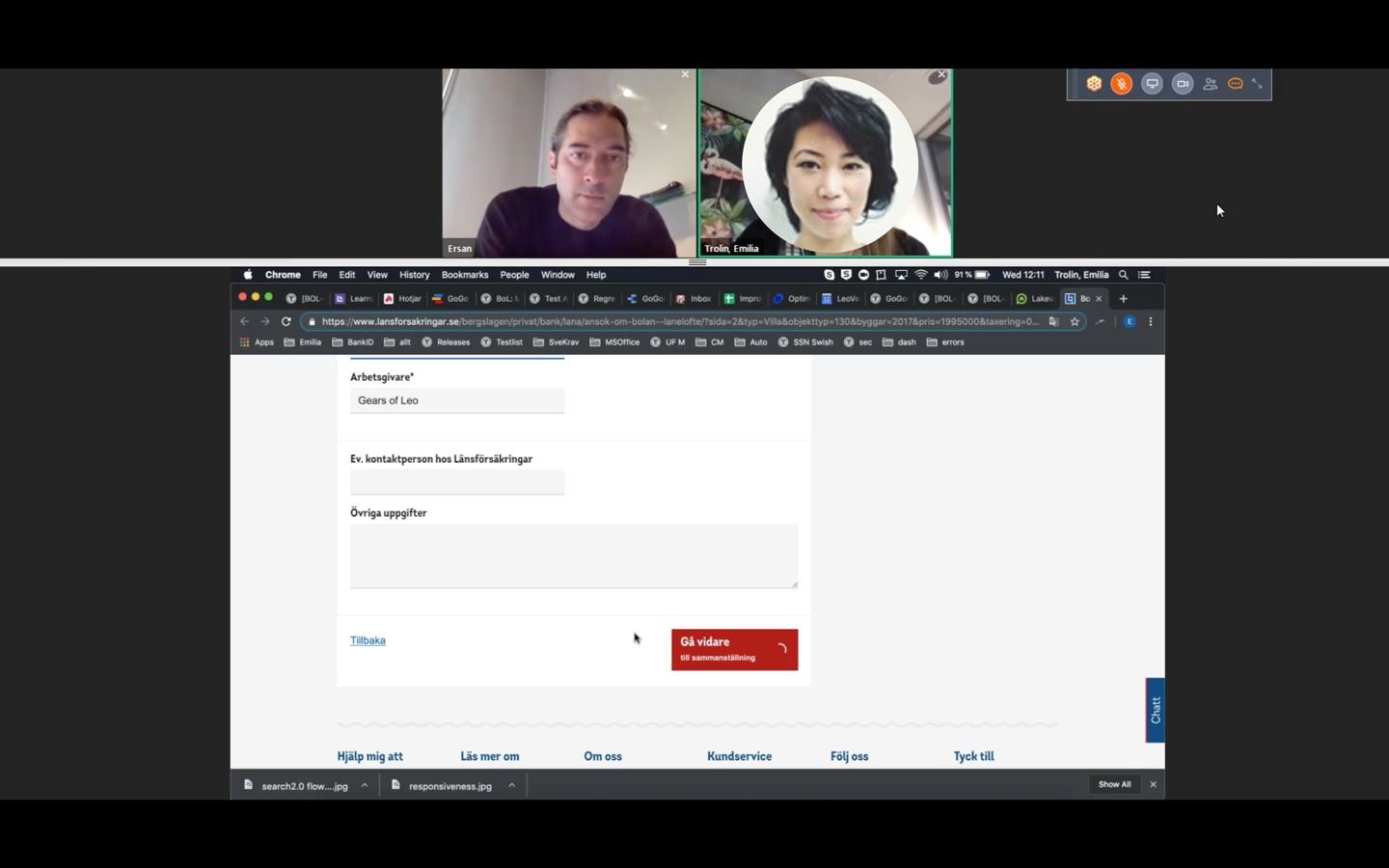

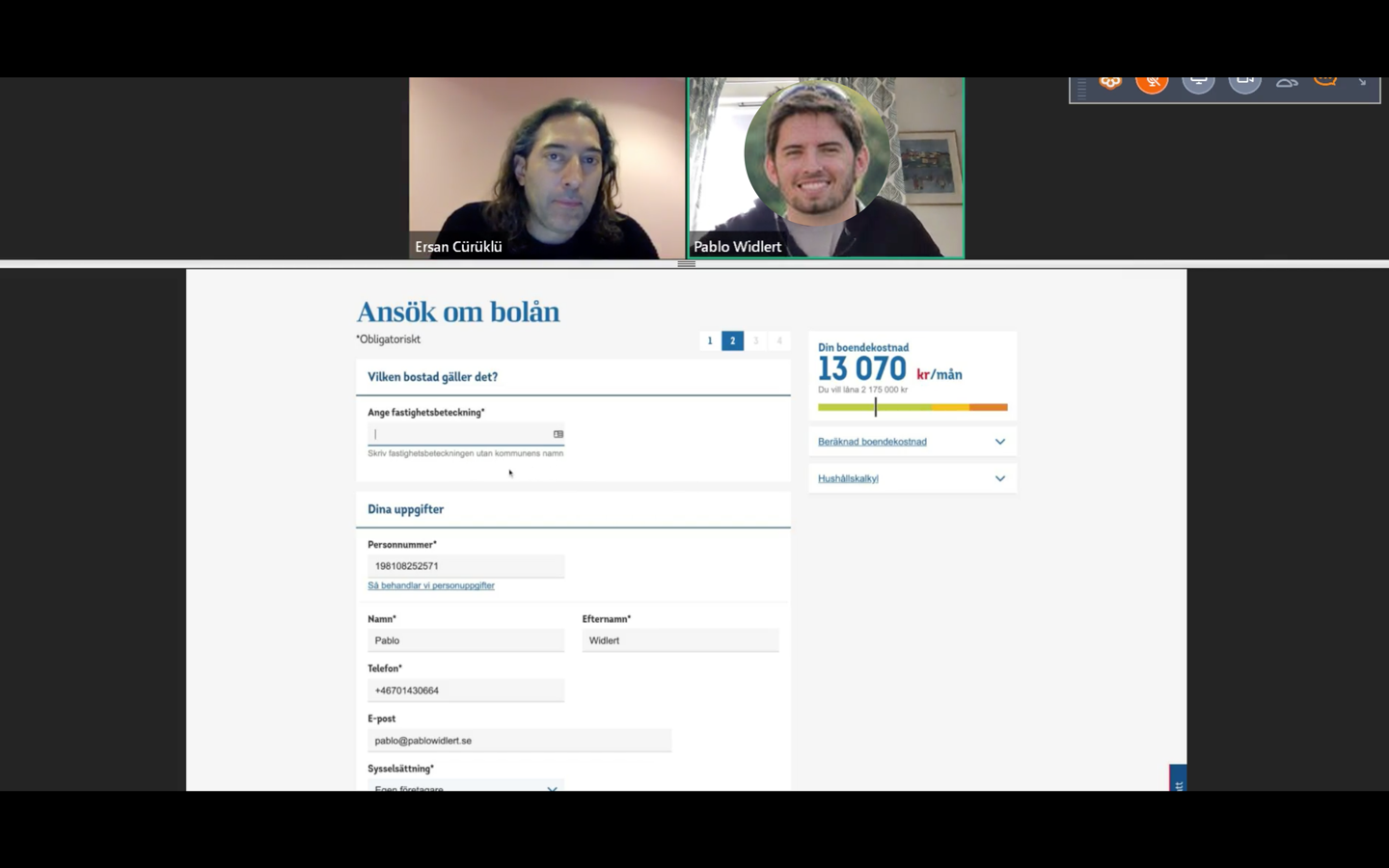

The work of developing the insights began through user tests via Testbirds, a service that makes it possible to test users all over Sweden since Länsförsäkringar is represented in twenty-three locations throughout Sweden.

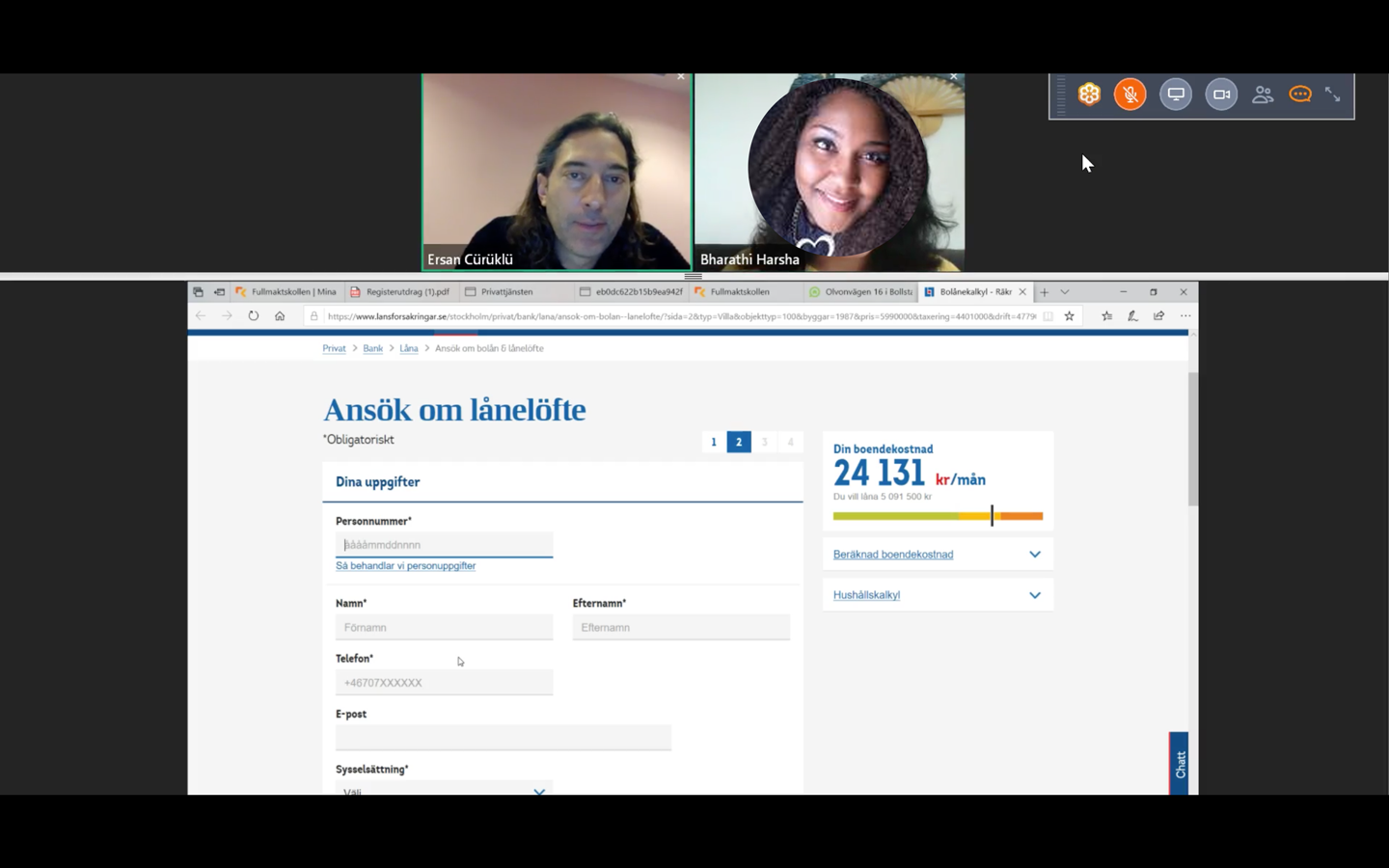

I led tests both in mobile and desktop to secure the most visited views. The tests identified the users' driving forces and how they reasoned about mortgages. These insights, in combination with data analysis, provided a solid foundation for the continued work.

Research methodOLOGY

Customer interviews

Interviews with bank staff

User and usability tests

Prototype testing

User and usability tests

Prototype testing

Customer journey mapping

Analytics

DATA ANALYSIS

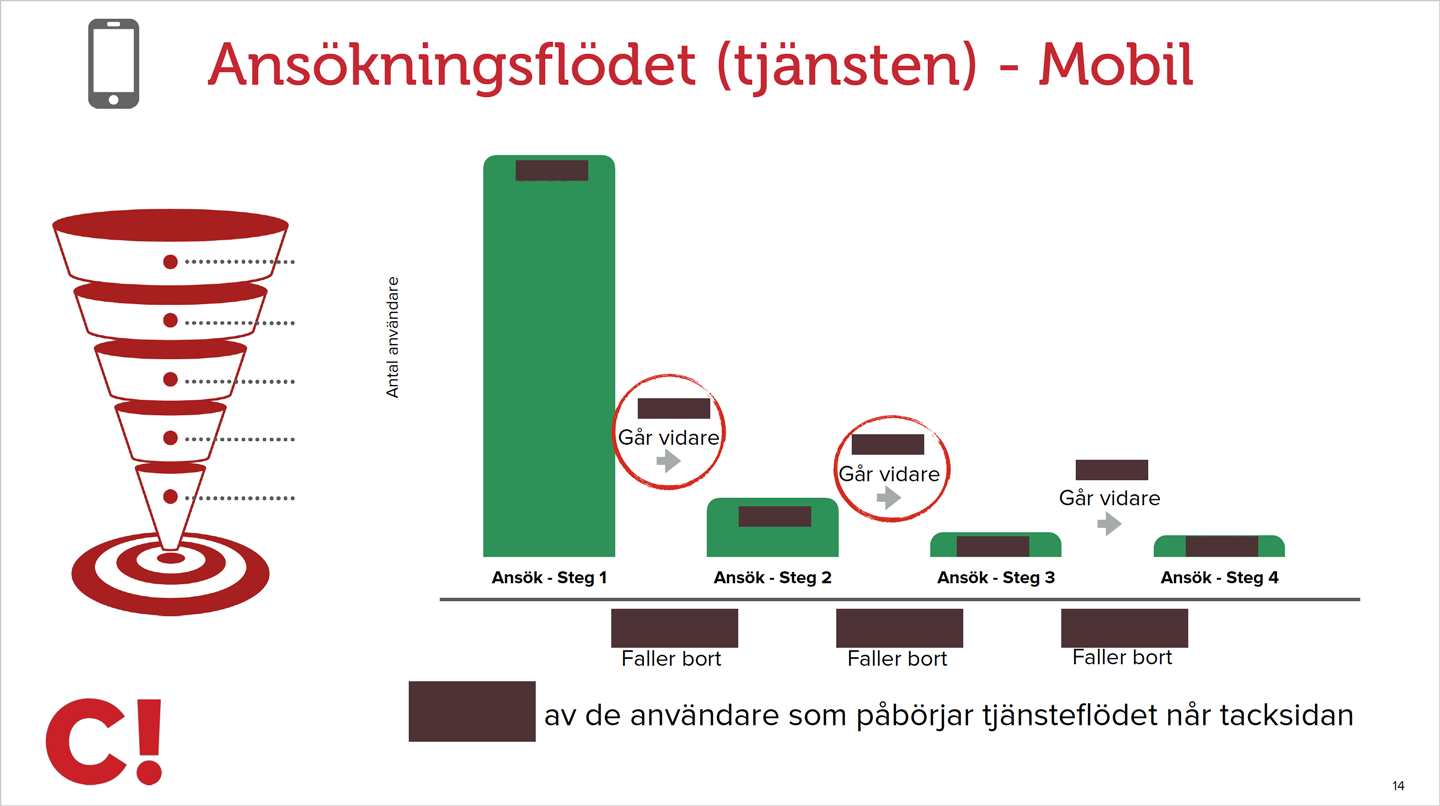

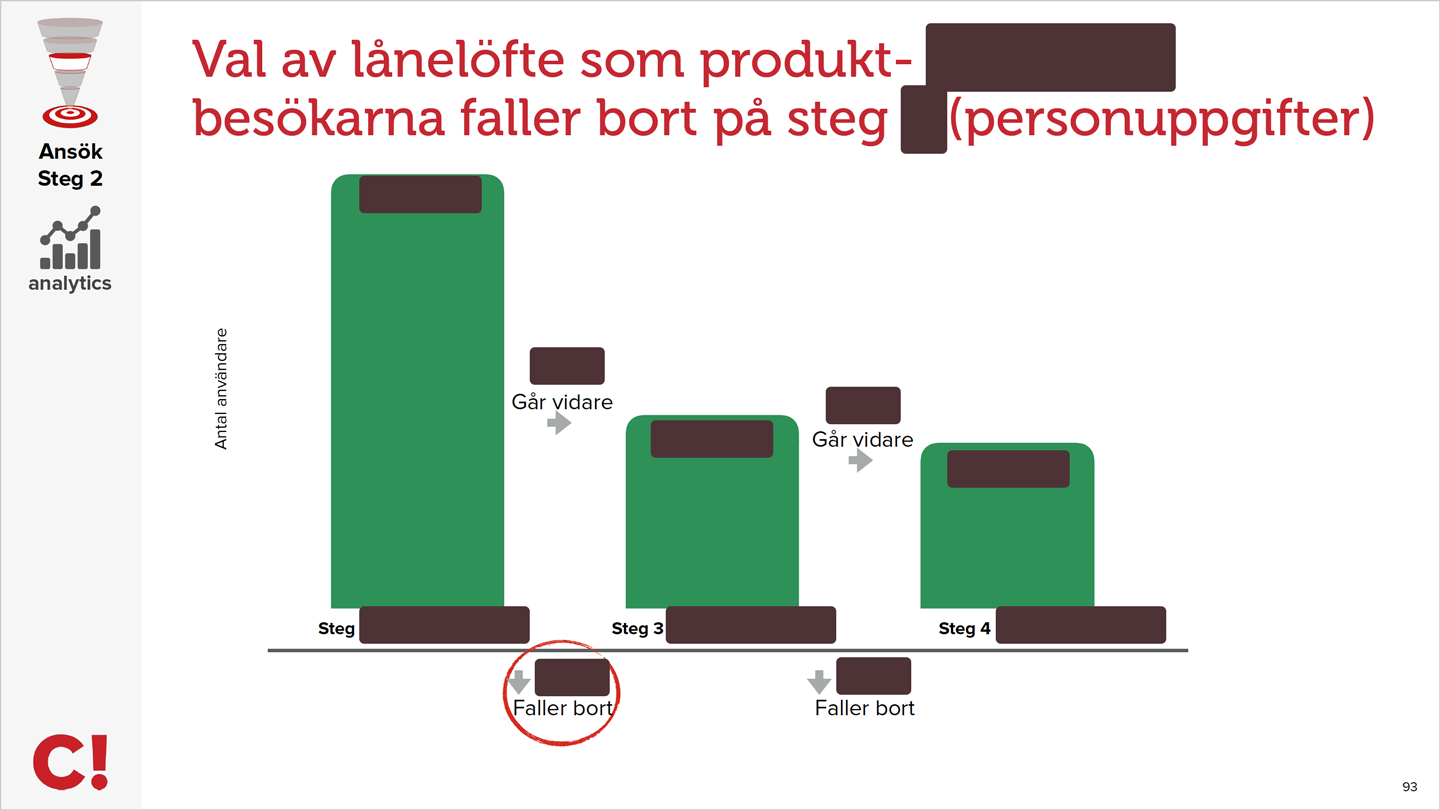

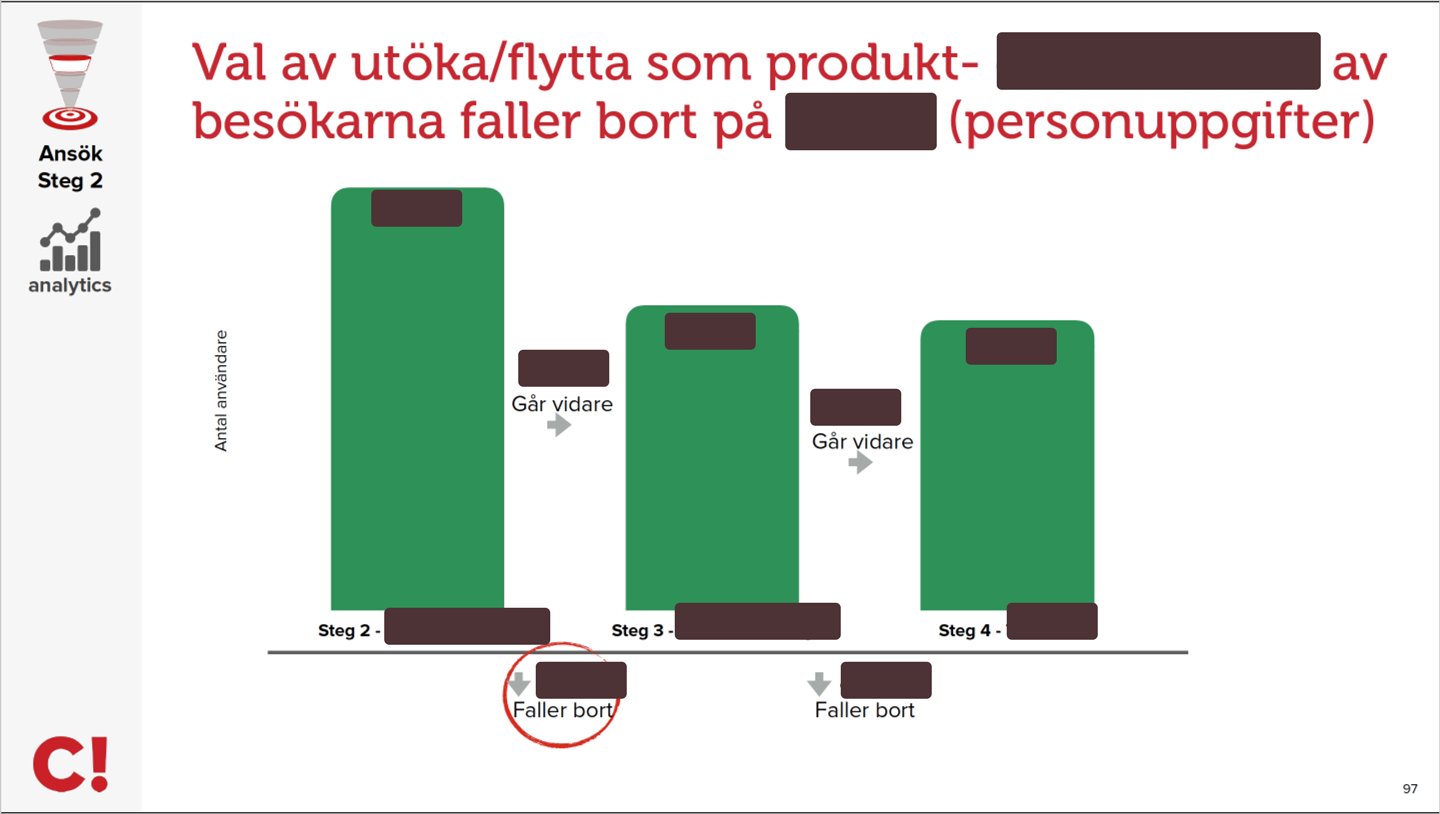

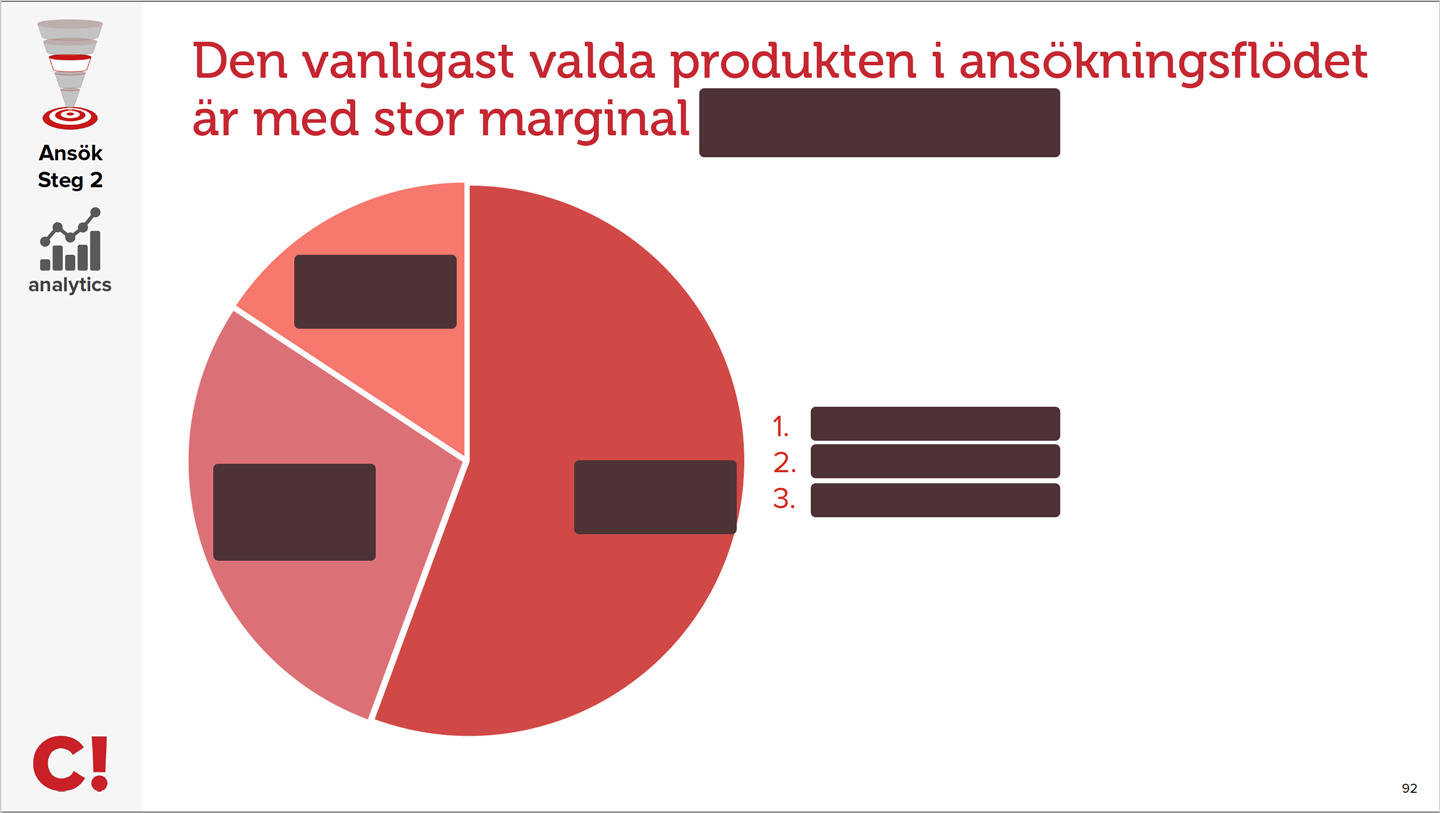

Prior to the work, extensive data analysis was conducted by Conversionista over a period of 12 weeks which showed shortcomings in how the flow was designed and how the users moved through the flow. The results were later used as a basis for the work of developing hypotheses.

New visible value proposition

An quality index (SKI, Svenskt Kvalitetsindex) banner was introduced to hopefully positively impact the attitude towards Länsförsäkringar as a bank, to increase the number of completed mortgage flows.

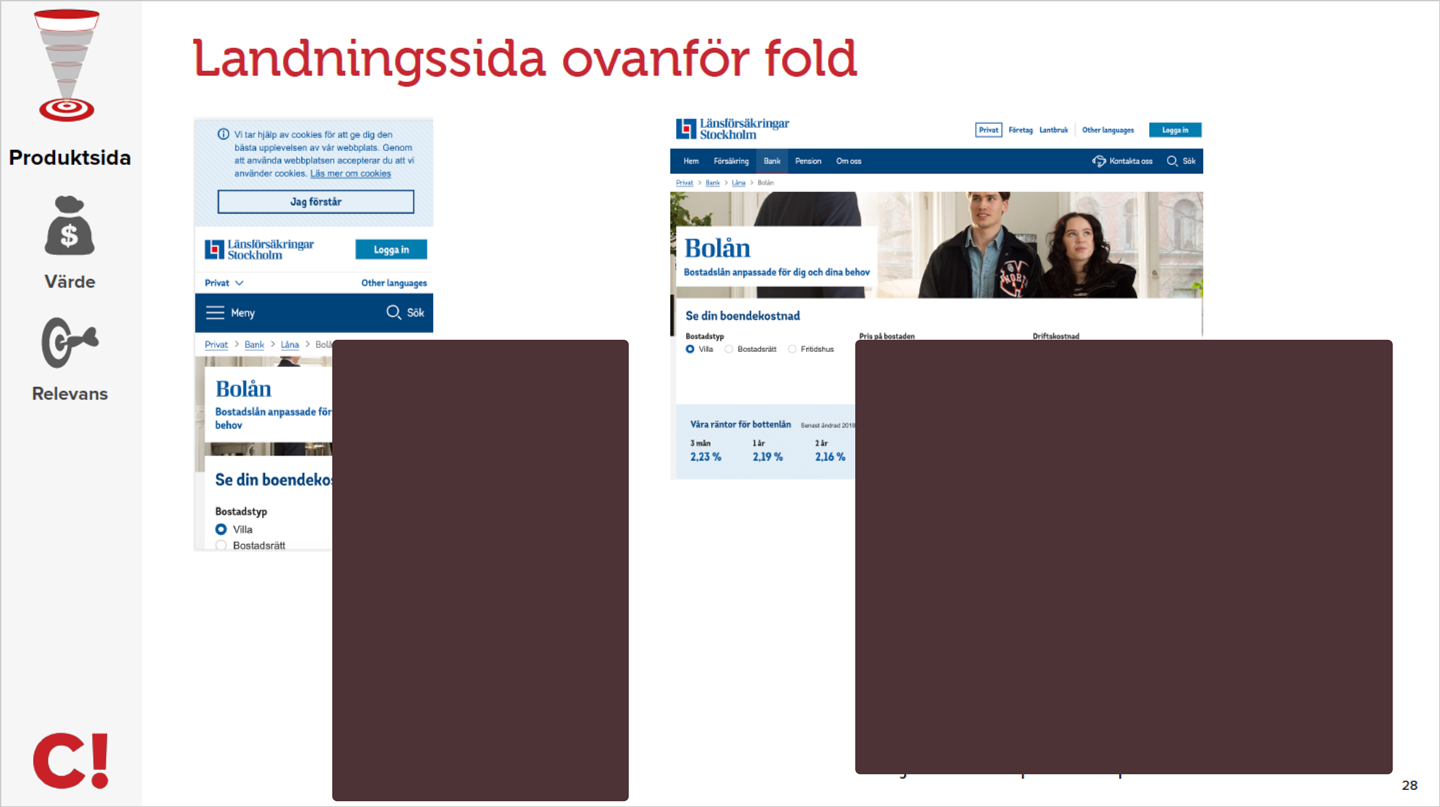

New and better calculation module

A new and improved calculation module is implemented for users to better understand and test different interest rates.

”Sticky” quick calculation

Quick calculation was made visible as a user scrolls down the flow. The user could now see changes without having to scroll up and down. We implemented sliders that enabled the user to work with the interest rate in a simpler way.

New mobile design

Improved mobile design for the users to navigate more easily through the various functions.

Project outcome

The result has been a well-functioning web with a steadily increasing number of visitors, a higher conversion rate and more satisfied customers. After the flow was released, a conversion increase of 5.23% in desktop and 6.97% in mobile was measured.